Farm Depreciable Asset Valuation

I.R.C. Sections 180 & 179… Get The Most Out of Your Farmlands Depreciable Assets

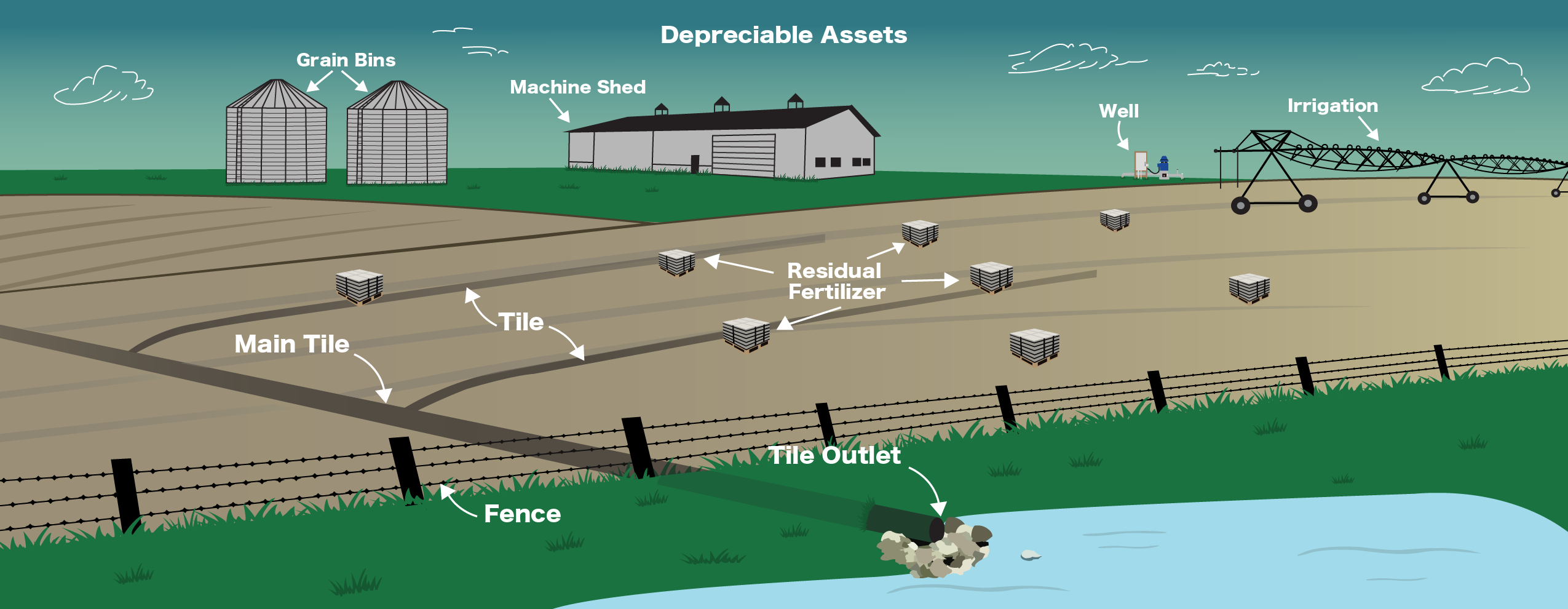

According to Internal Revenue Codes Section 179 (I.R.C. §179) and 180 (I.R.C. §180), farmland buyers, inheritors or recipients of gifted farmland could be eligible to deduct various depreciable farm assets, including but not limited to:

- Residual Soil Fertility

- Field Drainage Tile

- Farm Buildings

- Irrigation & Wells

- Grain Bins

- Fencing

Our team of agriculture professionals creates a 3rd party comprehensive report by analyzing the existing assets on a particular farm and determining their value. We currently provide FDAV services for Iowa, Illinois, Wisconsin, Minnesota, Missouri.

Rooster Ag’s expert Farm Depreciable Asset Valuations are assured to:

> Follow IRS guidelines.

> Utilize state-specific, university agronomic data.

> Be calculated based on your specific farm & soils.

> Verify “lease compliance”, as needed.

> Ensure an accurate value one can stand behind.

We even back up our work with a guaranteed minimum 100% return on your total tax savings based off a 30% tax bracket.

Factors we calculate to ensure compliance with I.R.C §180 include:

Beneficial Ownership of the Residual Fertilizer Supply

The tax advantage is to be utilized by the owner. The tax preparer can supply this information.

The Presence and Extent of the Residual Fertilizer

As of the date of acquisition, we determine the Residual Fertility Value by analyzing Soil Tests, Fertilizer Prices, and each field’s Optimum Levels of Soil Fertility.

The Residual Fertilizer Supply Exhaustion Schedule

After determining the Residual Fertility Value, we will calculate the time it would take for the excess fertility to exhaust from production if no fertilizer was applied.

Resources/Tools:

-View an example calculation of the potential tax savings using I.R.C. Sections 179 & 180, Click Here

-View FDAV brochure, Click Here

Free Consultation & Estimate

We are proud to offer a free, no strings attached consultation and tax savings estimate to guarantee you are taking advantage of all the depreciable assets on your farm. Please fill out the form below or give Dalton a call to get started!